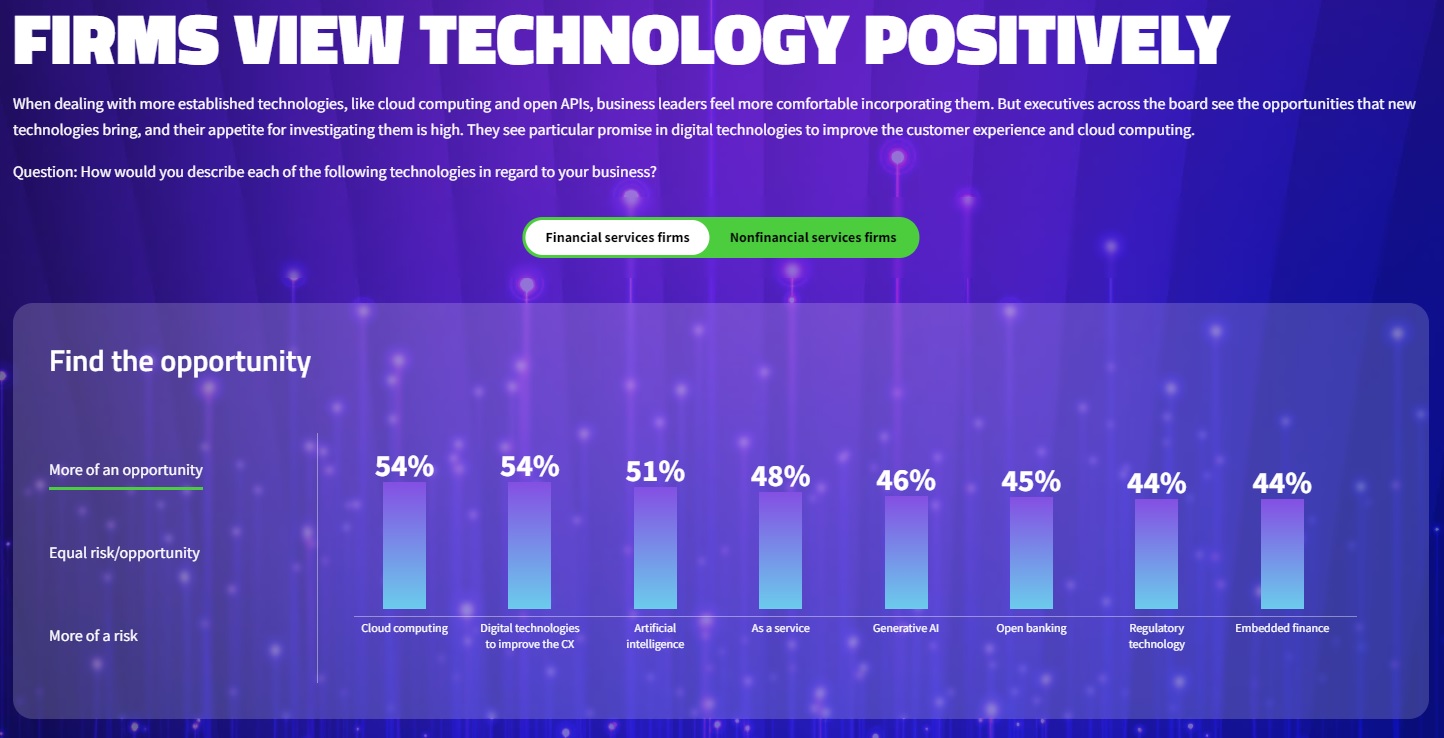

While financial forecasters continue to signal near-term economic downturns across the globe, FIS has conducted new research to understand how corporate executives across industries are innovating amid uncertainty.

FIS’ Global Innovation Report asked c-suite and senior executives in financial services (banks, insurers, capital markets firms, and fintechs) and non-financial businesses (technology, retail, energy and utilities, healthcare, and others) globally about their key areas of innovation over the next 12 months.

According to the study, business leaders in the UK say they face more risk now than in the past, with financial risk[1] as the top concern for 62% of respondents, followed by strategic risk[2].

Retail and fintech leaders are particularly concerned compared to other industries, with 80% of UK retailers and 70% of UK fintech executives noting rising risks to their business.

However, many organisations are embracing artificial intelligence (AI) to mitigate risk and unlock growth.

UK business leaders are already realising the potential of generative AI, with 60% of those who have adopted the technology saying they will increase spend on it in the next year, primarily to help them become more competitive.[3]

“UK business leaders are understandably unsettled by the risks posed by the current challenging economic climate, as supply chain disruptions, high interest rates, and skills shortages have piled pressure on to their performance,” said Nasser Khodri, Capital Markets Solutions President at FIS.

“But there are signs of optimism as executives eye emerging technologies, such as artificial intelligence, to boost productivity.

While there has been much hype around generative AI in particular, the Global Innovation Report indicates it has real practical benefits, with strong consensus among executives that it will increase their competitiveness.

If the technology is harnessed appropriately, it could be a gamechanger for the UK economy, which has been grappling with low growth.”

Key Findings and Insights

UK business leaders believe risk is rising, which may pose a threat to productivity:

- 47% of executives in the UK say they face more risk now than in the past.

- 52% of UK leaders who have experienced financial risk are addressing it by assigning existing staff to the problem; however, 42% of respondents say a lack of in-house expertise or knowledge challenges their ability to implement innovation solutions in response to risk.

- Leaders in retail and fintech are the most worried about risk when compared to their counterparts across industries, with 80% of UK retailers and 70% of UK fintech executives expressing concern.

UK executives are embracing innovation and AI to mitigate risk and unlock growth:

- 97% of UK executives say they are pursuing innovation strategies—or planning to pursue them in the next 12 months—to mitigate macro risks.

- 74% of UK leaders who are already using artificial intelligence (AI) or plan on using it say they see AI as a means to mitigate risk and 69% feel the same about generative AI.

60% of those already using generative AI say they are increasing spend in this area over the next 12 months, with 48% of respondents identifying increasing competitiveness as the top reason for increasing generative AI spend.

————————————————————————————————————————————-

[1] The survey defined financial risk as: supply chain disruptions, economic uncertainty, access to credit, increasing interest rates, increasing costs, etc.

[2] The survey defined strategic risk as: new/increasing levels of competition, difficulty recruiting/maintaining skilled staff, potential disintermediation from more nimble competitors, the need to digitalise, etc.

[3] The survey defined AI, exclusive of Generative AI, as: machine learning technologies for process automation and data analysis. Generative AI encompasses technologies designed to create new content from provided inputs, e.g. ChatGPT.

Source: Payments Card and Mobile