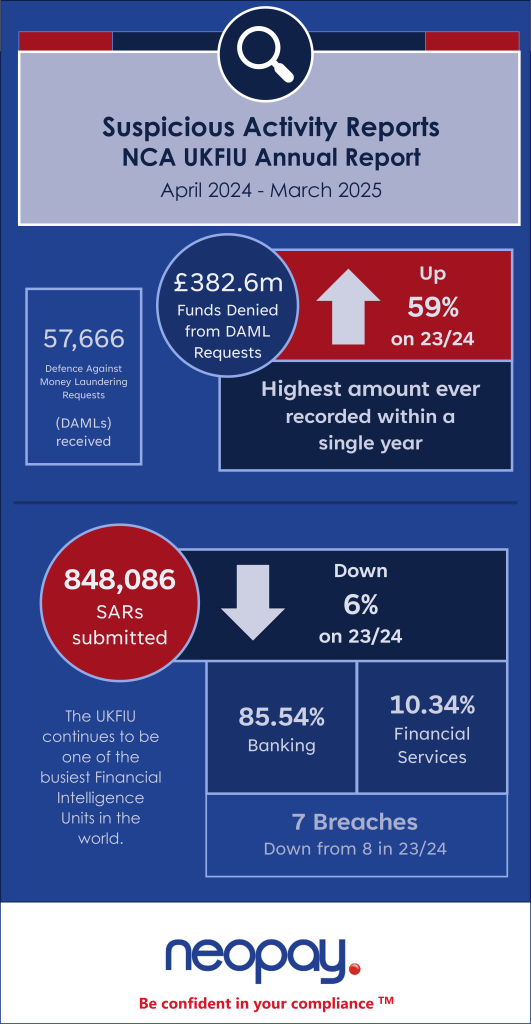

The UKFIU has published its SARs Annual Report which shows that Funds Denied from Defence Against Money Laundering (DAML) requests were up by 59% in 24/25.

The report shows the highest amount of assets ever denied from DAML requests within a single year period, with increasing numbers of DAML refusals and numbers of cases where assets were denied.

It indicates the increased quality of SAR reports submitted by firms as well as evidencing the growing scrutiny of reports through improved technology, systems and coordination across the UKFIU and their law enforcement partners and regulators.

For payments and e-money, this means that firms are increasingly experiencing Denied DAML requests and therefore cannot proceed with their proposed actions within their DAML request, such as paying away funds. If they continue with their proposed actions without a granted DAML defence, they will be acting without a criminal defence against money laundering offences, as well as facing severe regulatory enforcement actions and penalties for money laundering offences.

Firms should review their processes and controls to ensure they have robust enough safeguards to prevent inadvertently proceeding with proposed actions without a granted DAML defence. This should include reviewing training for your relevant team members to ensure that they’re up to speed on SAR and DAML related processes.

At Neopay, we can help by providing in-depth SAR training workshops or by incorporating this into your tailored financial crime training. Contact us to find out more.