Unauthorised financial fraud losses across payment cards, remote banking and cheques totalled £783.8 million in 2020 according to a report by UK Finance, the industry body.

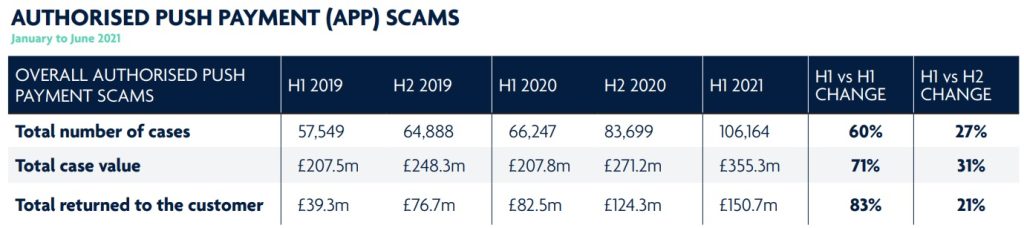

In addition, UK Finance members reported 149,946 incidents of authorised push payment scams worth £479 million.

Fraud is now so rife, not just in the UK market, that it is clear that it is being honed as a sophisticated business by the intelligent and well organised perpetrators.

The below is an excerpt from an article originally published in the FT.

It details just how fast fraudsters are able to move into “hot” areas to continue their illegal behaviour – very often aided by social media platforms which currently take no responsibility for their lack of action.

It took nearly three months and the intervention of a journalist before Meta, the parent company of Instagram, acted to recover 19-year-old Alex Bosley’s account after it had been hijacked by scammers last November.

By that time, dozens of Bosley’s followers had been duped into the same money flip, initiated on the popular messaging platform Snapchat, handing over funds and surrendering access to their Instagram accounts as part of a con that promised rapid returns on cryptocurrency.

The aspiring professional cyclist from Oxfordshire said one friend lost a £16,000 inheritance; another surrendered £19,000 he had saved from after-school work at a café.

Between them the group was defrauded of more than £100,000.

“It’s so easy to lose everything instantly,” Bosley said, adding that some of his friends were in financial difficulty and suffering mental health problems as a result.

Their experience has become commonplace, if no less traumatic for that, as crime has migrated online and fraud has grown to become the most prolific criminal enterprise in the UK.

Fraud accounted for 39% of all crime in 2020-21 as recorded by the Crime Survey of England and Wales (CSEW), rising from 30% in 2016-17.

Yet the degree to which it is overlooked was underscored last month when Prime Minister Boris Johnson omitted fraud altogether when citing statistics for crime in parliament.

With police firepower directed at higher-profile crimes, and social media platforms under little compunction to act, victims are often left without recourse to the law — although that could change if parliament approves government amendments to an online harms bill.

As the Social Market Foundation think-tank concluded in a report this month, the institutional and legislative landscape for tackling fraud in England and Wales is hopelessly under-resourced and outdated.

“Fraud is… a very unique crime as criminals can target victims while being based hundreds of miles away themselves — even overseas — which presents unique challenges to policing,” said Pete O’Doherty, assistant commissioner for the City of London police.

A rolling review since 2019 by the body monitoring police efficiency, Her Majesty’s Inspectorate of Constabulary and Fire & Rescue Services, has found that the capacity of forces to investigate fraud is still far “outweighed by the scale of fraud offences”.

According to the SMF, there are just 1,753 officers and staff focused on economic crimes, amounting to 0.8% of police forces.

Based on the CSEW’s higher figure, which captures scams that go unreported, that equates to just one dedicated police worker for 2,500 crimes each year.

“All these legacy structures are inertly trying to function while the landscape of fraud has completely changed with the evolution of technology and the emergence of sophisticated, organised crime groups operating like businesses,” said Richard Hyde, senior researcher at the SMF.

Bosley and his friends filed more than 1,000 reports alerting Instagram of the scam. But it was only when BBC Shari Vahl reporter for consumer rights programme You and Yours made inquiries in February that Meta recovered 50 hijacked accounts and the police got involved.

“They [Meta] are allowing people to use their platforms to scam people and they do nothing about it…we just kept hitting dead ends,” said Bosley.

Meta said: “Fraudulent activity like this is against our rules . . . We will continue to invest in people and technology to help detect and remove scams from Instagram.”

The most common form of scam in the UK is purchase fraud, where something is sold online but not delivered. E-scooters provided a recent lure.

The second most common, according to Jim Winters, economic crime director at Nationwide Building Society, is the investment swindle, such as the one Bosley fell for. In this scam, people are enticed into handing over money.

With banks becoming more adept at restricting unauthorised access to credit cards and accounts, more criminals have switched to this kind of social engineering.

There are many forms of “authorised push payment fraud”, where con artists entice their victims to carry out a transaction themselves.

“Fraudsters will hop on to whatever is hot,” said Winters, who argued that as well as improving police capacity, there needed to be a more strategic approach targeting kingpins and focused on prevention.

“I don’t think the police, even in the days when there was a bobby on every street corner, would have had the bandwidth to investigate a crime done remotely for £200,” he said.

“Banks are the only ones who refund consumers. But so many other industries have a part to play,” Winters said.

The online harms bill recognises this by making it a legal duty for the most popular social media platforms and search engines to eliminate fraudulent ads.

Placing a responsibility on firms to reimburse victims of fraud could rapidly transform their approach.

Perhaps another solution is for social media accounts to use real identities and treat them more like bank accounts.

Source: Payments Cards and Mobile