The prepaid debit and credit card industry has been steadily growing over the past few years with more businesses getting involved in the prepaid market arena. COVID-19 cannot be overlooked as an influencing factor in this industry, as it has accelerated the need for cash alternatives and overall demand for cards. As a means of coping and recovering, businesses and customers have both turned to prepaid credit and debit cards to get by. This increase in demand has seen the market value of US prepaid and debit card providers rise to $15.9 billion in 2022, with a growth rate of 5.5%.

Similar to the idea of a gift card, prepaid credit and debit cards are loaded with a budget that once you hit, is gone. You can then reload it at an ATM or participating store. The idea is that you can use it as an alternative to debit and credit cards and have better control of your money.

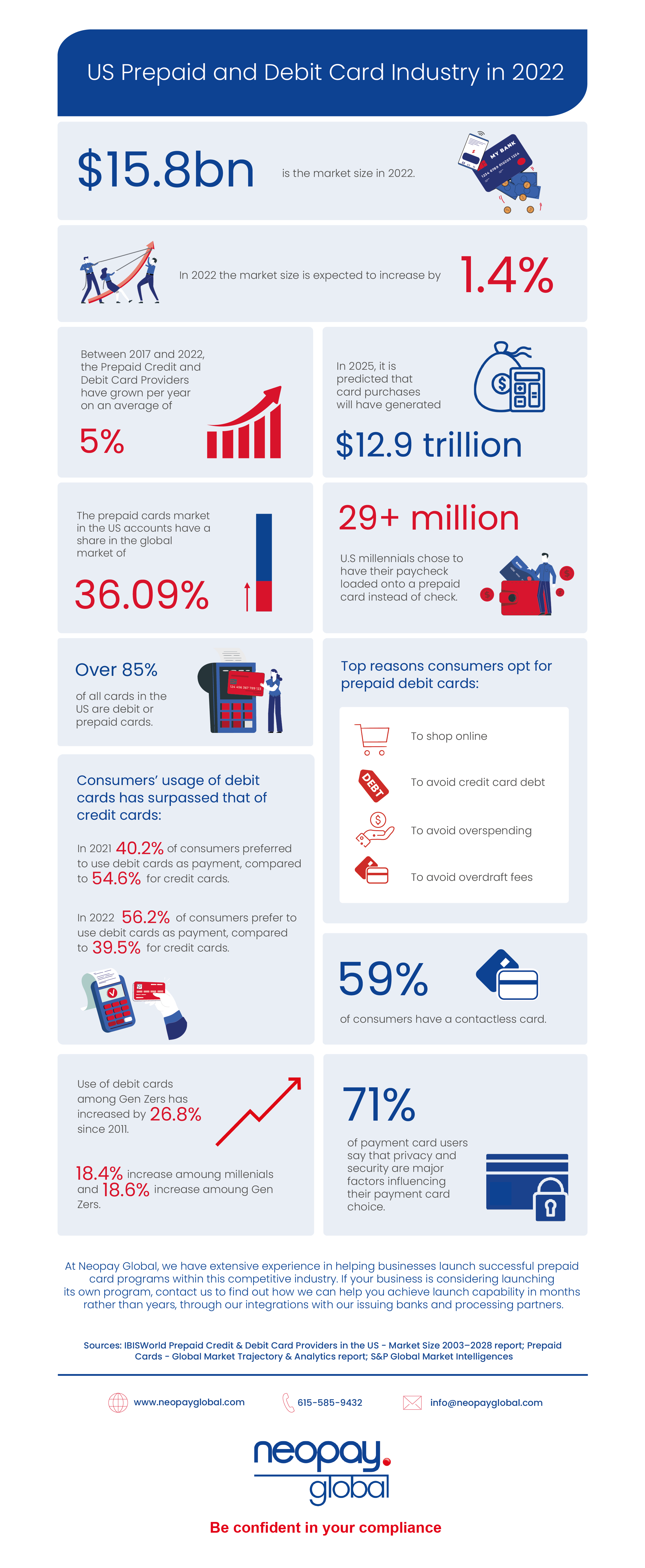

Using data from some of the most comprehensive financial reports, we’ve produced our latest infographic summarising some of the key statistics you need to know about the US prepaid and debit card industry in 2022.

Sources:

IBIS World Prepaid Credit and Debit Card Providers in the US – Market Size 2003-2028 report – This report aims to answer common questions about the future of the prepaid credit and debit card industry.

Prepaid Cards – Global Market Trajectory & Analytics report – This report focuses on the uptake of prepaid credit and debit cards due to the effects of, and recovery from, the pandemic.

S&P Global Market Intelligence – A finance and insurance company focussing on financial information and analytics.

Key findings:

- The market size in 2022 is $15.8 billion and is expected to increase by 1.4%.

- In 2025, it is predicted that card purchases will have generated $12.9 trillion.

- Between 2017 and 2022, the Prepaid Credit and Debit Card Providers have grown per year on an average of 5%.

- Over 85% of all cards in the US are debit or prepaid cards.

- The use of debit cards among Gen Zers has increased by 26.8% since 2011.

Click image to enlarge

How can we help?

Neopay aims to aid customers with our collection of leading regulatory compliance specialists. We at Neopay pride ourselves on getting results by offering bespoke compliance solutions to any regulation issue. We can help you develop your own prepaid card program within this competitive industry. Contact us today to find out how we can help you launch within months rather than years through our integrations with our issuing banks and processing partners.