In December 2022, HM Treasury published the “Anti-money laundering (“AML”) and countering the financing of terrorism (“CFT”): Supervision Report 2020-22”. The financial crime report provides information about the performance of the UK’s AML/CFT supervisors between 6th April 2020 – 5th April 2022, including the Financial Conduct Authority (FCA).

Unlike HMT’s previous AML and CFT supervision reports, which covered data for a single year, this latest report combines two years to address delays that developed due to the pandemic. The report highlights several important and revealing statistics regarding the approach taken by the FCA to financial crime supervision and enforcement during the time period.

Due to Covid-19 and government-imposed restrictions, the FCA’s supervisors were unable to carryout onsite visits and as a result sought to compensate with an increased “depth, breadth and intensity” of their desk-based reviews (DBR). Despite only being able to carry out DBRs, the FCA supervisory and enforcement action continued and increased by some measures, including the total value of fines imposed and the proportion of firms that were found to be non-compliant.

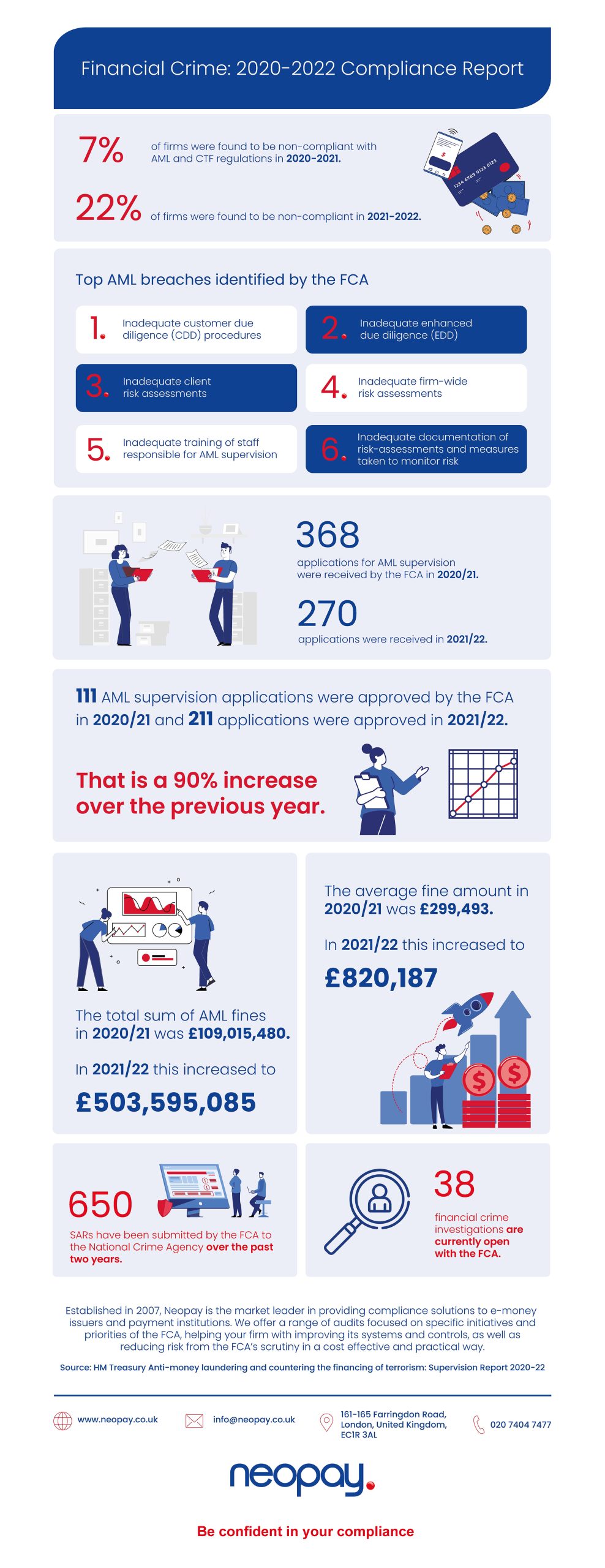

Our latest infographic highlights some of the key insights from the report concerning the AML/CFT supervisory focus and activities of the FCA during the two year period.

Key findings:

- Firms found to be non-compliant with AML and CTF regulations increased from 7% to 22% during the two year period

- The average fine amount increased by 173% from 2020/21 to 2021/22

- The total value of AML fines increased from £109m to £503m during the two year period.

How we can help

Established in 2007, Neopay is the market leader in providing compliance solutions to e-money issuers and payment institutions. We offer a range of audits focused on specific initiatives and priorities of the FCA, helping your firm with improving its systems and controls, as well as reducing risk from the FCA’s scrutiny in a cost effective and practical way.

Our Financial Crime Audits tackle all aspects of an effective and compliant financial crime programme, including some of the areas highlighted in the HMT report such as governance and senior management arrangements, appropriate levels of customer due diligence, customer and enterprise-wide risk assessment, training and awareness, as well as other aspects of financial crime, such as bribery and corruption, whistleblowing or fraud.

To find out how we help you manage risk and reduce internal compliance pressure, giving you total confidence in your compliance and AML solutions, contact us here.