Consumer Duty – latest upates

On 16 November 2022, Nikhil Rathi, the FCA’s Chief Executive, gave a speech at the UK Finance Annual Dinner on “Rolling regulation forwards”. In the speech, the FCA outlined its views on progress towards Consumer Duty implementation, coordination with the Financial Ombudsman Service, and the impact on financial inclusion.

The key points to note are:

- Parliament debated and explicitly mandated the Consumer Duty due to falling public confidence in retail financial services.

- After extensive feedback, the FCA introduced a phased deadline to help firms embed what is undoubtedly a major cultural and operational shift.

- Firms seem to be on track therefore the FCA does not see need for those deadlines to move again.

- The FCA will remain pragmatic in their oversight of implementation and ask for continued openness from firms on their implementation path.

- The FCA recognise how critical coordination with the Financial Ombudsman Service will be for successful implementation.

- As the Ombudsman has made clear, the Consumer Duty does not have a retrospective effect. Conduct will be judged on the rules and standards in place at the time.

- The FCA will be monitoring closely to make sure the Consumer Duty does not prompt risk aversion in firms and the withdrawal of products for difficult to reach groups.

- After some heavy lifting upfront, the Duty should mean fewer reactive rules created by the FCA in the coming years.

To read the full speech, click here.

The FCA also held a series of industry-specific webinars to address how the Consumer Duty applies to the regulated firms in different sectors and what the FCA expectations are. Here is a summary of the key points covered in the FCA’s webinar aimed at payment and banking services .

How will the Consumer Duty make a difference?

- It extends the FCA rules on product governance and fair value, which already exist in certain sectors, across all sectors.

- It tackles complex areas of market practice, like sludge, that interfere with consumer decision making.

- It puts the onus on regulated firms to anticipate and respond to emerging harms.

- It expects firms to consider the diverse needs of customer, in particular those with vulnerabilities, at every stage of the lifecycle of the relationship.

- It enables firms to define, monitor, evidence and stand behind the outcomes their customers are experiencing.

Consumer Duty structure

The Consumer Duty is a package that consists of various aspects.

Outcome based regulation – example for payment services firms to assess the outcome ‘product and services meeting customer needs’

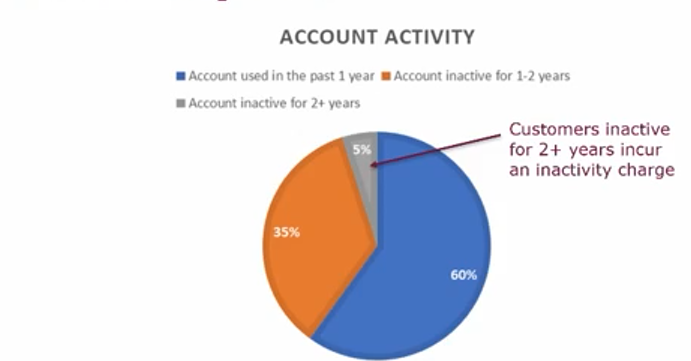

Below is an example of a hypothetical e-money firm with an e-money product. One of the features of this product is that it charges an inactivity fee if the account hasn’t been used for two years or more. The pie chart shows the breakdown of customers usage – 60% of customers used the account in the past year, 35% of customers have not been active between 1-2 years and 5% of customers have been inactive for two or more years, incurring an inactivity fee.

Inactivity Fees

The first questions that any regulated firm should be asking itself are: “Does the product meet the needs of a customer?”, “Is a customer incurring this fee as a result of friction in a customer journey or is the customer trying to switch or close the product but not being successful?“, “Does the customer understand the product and the inactivity charge?”

Secondly, the firm should also analyse the group of 35% of customers who are coming up to the period when the inactivity fee will be triggered and ask itself: “What sort of prompts or communications should we be issuing for those customers to ensure they understand that a fee may be charged after 2 years?”, “Do our customers understand the product?”, “Why aren’t customers fully engaged in using the product?” .

General principles of good practice under the Duty

- Firms must design and deliver support that meets the needs of customers, including those with characteristics of vulnerability (for example, must be effective and timely).

- Firms must enable and support customers to pursue their financial objectives (for example, having a single digital channel may not be sufficient, lack of face-to-face support such as telephony to be able to speak to a real person, support for urgent queries such as fraud).

- Firms must support customer understanding.

- Firm must enable customer to make effective decisions.

- Firms must test, monitor and adapt communications to support understanding and good outcomes.

- Firms should avoid inadequate support of channels.

- Firms should avoid inadequate resourcing of channels, including in terms of capacity or relevant staff experience (leading to long waiting times to be connected, or hold times to get information).

- Firms should avoid poorly designed or prematurely launched digital channels (for example, being too complex or slow to navigate).

- Firms should avoid excessive reliance on chat bots (as they may not provide the required level of support, where customers query is too complex or specific to be handled by a bot and needs to be referred to an associate).

Support Outcome Metrics

- Firms must have metrics to monitor the quality of support offered, looking for evidence of areas where it may be falling short and acting promptly to address them.

- Metrics to assess customer support could include queue time at branches or offices, wait time and abandon rates in telephone, abandon rates and response times for digital channels).

Consumer Duty and Payment Services

The Duty applies to the regulated activities and ancillary activities of all firms authorised under the Financial Services and Markets Act 2000 (FSMA), the Payment Services Regulations 2017 (PSRs) and E-money Regulations 2011 (EMRs), in respect of products and services for prospective and actual retail customers.

The FCA recognise that the payment services sector is very diverse with at least thirteen different business models, therefore there is no ‘one fits all’ approach.

The Duty calls for firms to put consumers at the centre of their offering; this is crucially important for payment and e-money firms as they execute transactions essential to the financial wellbeing of individual consumers and the wider economy and hold and safeguard monies received from its customers.

Consumer Duty – What you need to know

What is the Consumer Duty?

The Consumer Duty is one of the new regulatory initiatives which focuses on customer protection across the four main areas: products and services, price and value, consumer understanding, and customer support.

Who does the Duty apply to?

It applies to the regulated activities and ancillary activities of all firms authorised under the Financial Services and Markets Act 2000 (FSMA), the Payment Services Regulations 2017 (PSRs) and E-money Regulations 2011 (EMRs), in respect of products and services for prospective and actual retail customers.

The Duty applies to products and services offered to ‘retail customers’. For payment service or e-money providers, the Duty applies to business conducted with consumers, micro-enterprises and small charities with a turnover of less than £1 million and a natural person acting in a capacity as a trustee if acting for purposes outside their trade, business or profession.

What are the deadlines?

At this stage, the FCA has confirmed their plans to implement the Consumer Duty. The Duty is part of the FCA’s three-year plan to improve financial markets for retail consumers; firms will have 12 months to bring their products up to the standards of the Duty, with an additional 12 months for any closed-book products.

The rules and guidance that will be introduced, come into force on a phased basis:

- For new and existing products or services that are open to sale or renewal, the rules come into force on 31 July 2023

- For closed products or services, the rules come into force on 31 July 2024

Key milestones during the implementation period and what should you be doing right now

Approved Consumer Duty implementation plans

The first implementation milestone was at the end of October 2022, when the FCA required that the Board agreed their implementation plans. As always, the FCA confirmed that they may request to see the implementation plans, Board papers and minutes.

The implementation plans should demonstrate that firms made a clear plan to implement the Consumer Duty in time and in accordance with the FG22/5 .That being said, the FCA does not expect firms to have fully scoped all the work, but it should demonstrate that firms set out how they will deliver the implementation.

Consumer Duty Champions

Another FCA expectation is that firms appoint a Board Champion (someone at Board level) to ensure that good outcomes for consumers are central to their firm’s culture, strategy and business objectives. The FCA recommend that the Champion to be an independent non-executive director (NED) where possible, considering size and structure of the business. For example, for some firms it may work well for the Chair of the Board to also be the Champion for Consumer Duty. However, as this is not a prescribed responsibility under the SMCR, the FCA are not prescriptive about the role and allow firms to set it up the way it fits the existing roles and responsibilities on the Board.

The role of the Champion is to support the firm to ensure that the Consumer Duty is being raised regularly in all relevant discussions (e.g. a Board or Committee meeting) and that the Board is challenging on how the Consumer Duty is being embedded with a focus on consumer outcomes. The Champion is not an executive role and they are not responsible for the firm’s implementation or compliance with the Consumer Duty. They are responsible for ensuring it is discussed at the Board. The Guidance (FG22/5 ) provides examples of the types of questions the Champion could ask to assure the firm is meeting expectations under the Consumer Duty.

Whilst there was no specific deadline, it was recommended that this appointment be in place by end of October 2022 to align with the approval of the implementation plans.

What are ‘closed products’?

The Consumer Duty comes into effect on:

31 July 2023 – for new and existing products or services that are open for sale or renewal

31 July 2024 – for closed products or services

Closed products are those that are no longer marketed or distributed to retail customers or open to renewal. Where existing customers can continue to make payments under the existing product terms this would still be considered closed, as long as the product or service is not open to new customers. For example, a product which is no longer sold to new customers, but where existing account holders can continue to pay in contributions, would be considered closed.

What are the key outcomes under the Duty?

Here are the key areas of focus that you need to map all your business activities and processes against:

- Consumer understanding, where products come with timely and clear information that customers can understand so they can make informed financial decisions.

- Products and services that meet customers needs, rather than pushing products that aren’t suitable or needed. Whilst PPI (Payment Protection Insurance) claims feel like history, they are not and consumer are pushed into high-risk investments, unaffordable high-cost credit or debt products.

- Consumer support without experiencing long call-waiting time, compensated for lacking access to in-person services such as bank branches, and finding best ways of customer support throughout the relationship, both digital and non-digital. Whilst firms losing customers is not the FCA’s intention, the aim is to see competitive markets, where it is as easy to switch, cancel or complain about a product, just as easy as it is to buy it in the first place. The FCA will be closely looking at the appropriately set exit fees.

- Price and value that are reasonable for the benefits of the products and services offered.

How will the FCA supervise the implementation and compliance with the Consumer Duty?

The data that the FCA will collect will focus more on consumer outcomes and looking at the whole product life cycle. The FCA will be requesting evidence from firms of what consumer outcomes are being achieved, and how firms are assuring themselves that they are meeting these outcomes.

For more information

For more information on the Consumer Duty, read the FCA’s briefing here, or see the Policy Statement and Final Guidance document.

If you’d like to know more about how we can assist you with implementation of the Consumer Duty or how we can support you with authorisation arrangements, or any other regulatory compliance matters, please contact our specialist team here.